Are Rolex Watches a Good Investment? According to the Data, the Answer is a Resounding, YES!

It’s no secret that Rolex is hands down the most sought after and in-demand watch brand in the last… well, ever. Even more recently the demand has led to so much of a shortage, that the notoriously reclusive brand had to issue a statement to the masses about its supply shortages, and all-around seemingly lack of access to their pieces. Was it a typical Rolex non-answer? Of course. But a statement in any sense from the brand was a telling adventure in semantics.

Like any “good” investment in the luxury product space, the bread-and-butter formula for qualifying a product for value increases is “High demand, Low availability”. I’d add a third qualification in there, and that being “price accessibility”, meaning it’s not too expansive that only a few can afford it. While we see very expensive pieces following similar investment patterns, we rarely see the availability added to the formula - meaning that so little are produced, it’s largely irrelevant to most consumers. In the case of Rolex, they sit very much on the top of the hill for all three categories. Price? Attainable. Demand? Very very high. Supply? Very very low.

This has led Rolex to outperform just about every other means of investment in the last decade - Literally - Real Estate and Gold even…

Bob’s Watches has published a telling set of sales data that sheds quite a bit of light on just how lucrative hanging onto a Rolex has been. Starting in 2011, a used Rolex (on average) would cost a buyer a little over $5,000 - compared to 2022’s grand total average of almost $13,000. While we’ve seen a really steady increase over the first 7 years of data, Covid has shot prices through the roof. With a huge chunk of that increase coming in the last 18 months.

Image Courtesy of Watch Trading Co.

The increases, unlike originally projected, aren’t just restrained to Rolex’s steel watch offerings. In fact, some models, such as the Day-Date 40 in rose-gold have reached a near 100% increase in just the last 10 months. While Rolex has incrementally (and slowly) increased the MSRP on in-production models over the last ten years, the secondary market has increased by 3-digit percentage points in some cases

While some models have increased less (looking at you Air King and Cellini), others have absolutely soared. The Daytona for example has seen well over 100% increase in the grey market, so has the Skydweller. Even once less popular models like the Milgauss and Yachtmaster II (reviewed here) have still seen major shifts upwards, especially in the last 11-24 months.

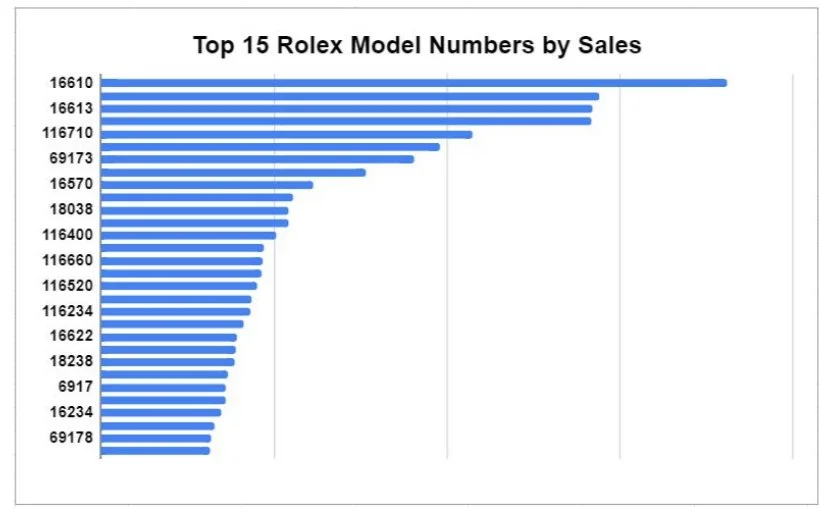

Image Courtesy of Bob’s Watches.

Interestingly, and I suppose unsurprisingly, the 116610 Submariner tops the list of most sold watches, with its 16613 “Bluesy” two-tone cousin following in close pursuit. These two, have historically been amongst the most economical offerings from the brand, but have recently delved into a class of their own on the secondary market. Since Bob’s Watches is a grey market dealer, we see that there doesn’t seem to be much resistance paying 2-3x retail for a standard Rolex tool watch. Amazing.

Image Courtesy of Bob’s Watches.

Interestingly, some of the more popular increases in prices have been a number of the lady’s watches, occupying 3 of the top 15 spots (with the two-tone Datejust Being the 4th best selling). Of the top 15, over half were sports watches, while the rest are pretty well what you’d expect them to be - Datejusts and the like.

Also, the GMT-Master II has seen a sweeping increase across the board. And with Rolex recently increasing the MSRP on the line, it’s definitely carried over into the secondary market.

Image Courtesy of Bob’s Watches.

So what does this mean? Is Rolex a good investment?

The data would suggest yes - So long as you’re willing to hold onto the watches more than a few months. Running into supply and demand issues has opened up a world of investment opportunity for fans of the brand that isn’t oft enjoyed by other means of investors.

The real issue comes into play when you go to get one. The practice of “flipping” watches is typically frowned upon by the same markets you’d be able to attain the watches at MSRP anyway, that that will present its own set of challenges. And when you mix that into some of the more shady business practices and purchase history Requirements, actually acquiring these pieces are difficult - to say the least. Then, openly (or even not so openly) flipping those watches could risk landing you on a maybe-it-exists-maybe-it-doesn’t (it definitely does) blacklist for future purchases.

The increase in watch flipping has definitely been on the rise. We’ve seen a number of popular shows like Grey Market on YouTube, or Watch Trading Academy pop up and it’s made a lot of people feel really qualified to do it. It looks so easy.

In reality, it’s not. And expert navigation of the market is largely required to be successful. A large part of that is how many grey market dealers are easily able to swallow up the little supply there is, leaving a huge portion of the end-user market unable to obtain the pieces anyway.

So? Are Rolexes good investments? Sure. Are they necessarily the most practical? No.

Let us know your thoughts on the comments below!